Kuala Lumpur, 23 January 2024 — A significant portion of Malaysians lack financial literacy, leading to poor financial decisions, inadequate coverage, and missed opportunities for wealth creation. Amidst these pressing challenges, homegrown financial planning platform Finalyst emerges as a potential solutions provider, empowering clients with real-time collaborative and communicative bonds between financial planners and clients.

Current trends show that many members of the Malaysian public make consistent use of credit cards and easy payment schemes to spend money yet to be earned — something that is cause for serious concern. Adding to this are the results of a poll by a leading tertiary institution showing that 73 percent of Malaysian youth are currently in debt. Meanwhile, financial intermediaries find themselves encountering difficulties in providing comprehensive financial planning services, limiting their ability to capitalise on long-term business prospects.

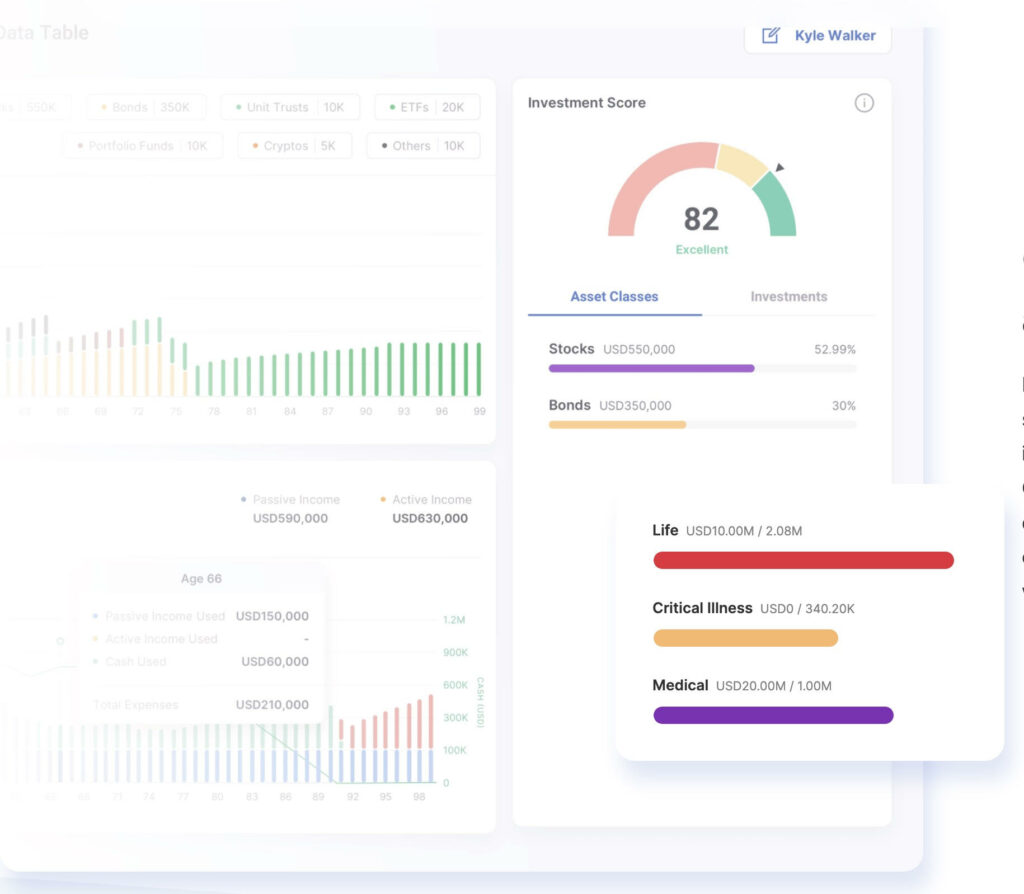

Aiming to enhance financial literacy and address the escalating debt levels among Malaysians, Finalyst, a first-of-its-kind financial health assessment platform,boasts state-of-the-art tech designed to enhance cash flow management, investment strategies, and insurance planning. The collation of this data then enables them to identify potential shortfalls and promote wealth growth through a suite of powerful tools, whileimproving efficiency and advisor-client partnerships through automated and user-friendly interfaces.

The platform also offers custom financial plans tailored to each client’s unique goals, providing recommendations for cash flow management, insurance, investments, retirement planning, and more. Clients can visualise their financial scenarios, simulating various situations and events to explore the impact of changes in their financial position. Meanwhile, efficient monitoring and reporting functionalities track clients’ progress towards financial goals, generating comprehensive reports for both clients and financial planners.

“There are avenues for the public to capitalise on wealth creation opportunities, but the gap in financial literacy leaves most of us unaware of this. Meanwhile, financial planners find it difficult to connect with clients on these same grounds; the clients feel nervous and uncertain, while the planner often has to expend a lot of energy first to clarify opportunities and then to determine whether the resources needed to access said opportunities exist. Our goal with Finalyst is to make this process as seamless as possible,” shares TJ Tee, Co-Founder of Finalyst.

Via its user-friendly interface, Finalyst makes complex financial planning accessible and understandable for users at all levels of financial literacy withmobile app integration ensuring convenience and real-time updates for users on the go. Finalyst is also currently strategising the integration of AI and machine learning capabilities in the app, paving the way for advanced, personalised financial solutions.

“For the financial planners, they now have all the information at their fingertips, which makes it easier for them to chart out a comprehensive plan for their clients. On the client’s side, they will now be able to see everything clearly — which gives them a better understanding of how their finances are being used, and how they can direct their finances to help them achieve their financial goals,” adds Casper Foo, Co-Founder of Finalyst.

In terms of regulatory standards, Finalyst prioritises user data safeguarding and complies with the Personal Data Protection Act (PDPA) to uphold stringent data protection standards. Embracing the secure Amazon Web Services (AWS) platform enhances data security, scalability, and overall service reliability.

Finalyst’s launch marks a significant step toward a transformative journey, seamlessly integrating technology with financial success. By addressing challenges faced by the mass public and financial planners alike, they aim to redefine the financial planning landscape in Malaysia for the better.

To learn more about Finalyst and what they have to offer as a platform, visit https://www.finalyst.app/ .